Centre for Environment Justice (CEJ) has appealed to insurance companies in Zambia, to urgently compensate farmers enrolled in Weather Index Insurance schemes.

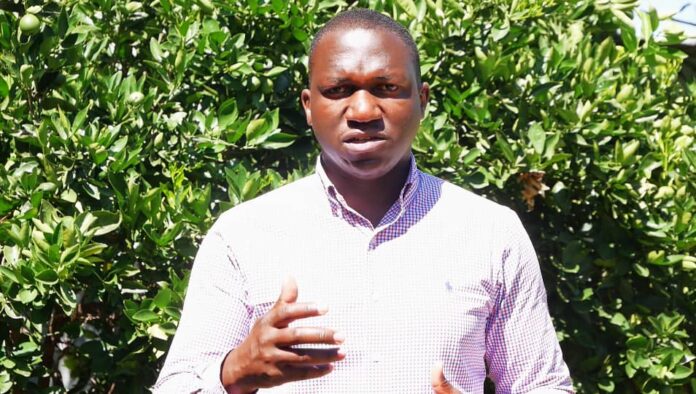

CEJ Head of Research and Studies Freeman Mubanga said farmers especially in Southern Province, who are affected by an erratic rainfall pattern, are awaiting clarification from insurers on compensation mechanisms.

Mr. Mubanga said the introduction of the Weather Index Insurance in Zambia represents a significant step forward in the fight against the impacts of Climate Change on agriculture.

He said by linking insurance payouts to weather conditions rather than individual crop losses, the innovative initiative offers a direct response to the challenges posed by climate variability.

The CEJ Head of Research and Studies, however, said it is crucial that insurance providers execute their compensation duties with both efficiency and transparency for the system to effectively support the agricultural sector.

Mr. Mubanga said recent observations indicate a growing concern among farmers regarding the timeliness of these compensations.

He said a significant number of farmers participating in the Farmer Input Support Program (FISP) have invested K100 towards Weather Index Insurance, demonstrating their trust in the system to provide a safety net against climatic unpredictabilities.

“However, the effectiveness of this insurance model is contingent upon the insurers’ ability to promptly assess and compensate for crop losses,” he said.

Mr. Mubanga said delays in processes can severely impact farmers’ ability to recover from adverse weather conditions and prepare for the upcoming farming season.

“In light of these considerations, we strongly recommend the following actions to insurance companies providing Weather Index Insurance in Zambia: Enhance Transparency and Communication; Insurance companies should establish clear, accessible channels for communicating with farmers regarding the status of their insurance claims and the timeline for compensation. Regular updates on assessment processes and expected payout dates can significantly alleviate farmers’ anxieties and foster trust in the insurance mechanism,” he said.

Mr. Mubanga further recommended streamlining Assessment Processes by implementing more efficient technologies and methodologies for crop loss assessment can expedite the compensation process.

“Remote sensing technology, for instance, offers a promising tool for quickly evaluating weather-related damages over large areas,” he said.

GET MORE NEWS UPDATES

The CEJ Head of Research and Studies called for Building Capacity for Rapid Response by ensuring that Insurance providers invest in their operational capacities to respond swiftly to weather events.

“This could involve training dedicated teams to handle claims during peak periods of weather-related damages,” he said.

Mr. Mubanga recommended Engagement in Continuous Improvement by ensuring that Insurers actively seek feedback from farmers and other stakeholders to identify bottlenecks and areas for improvement in their service delivery.

“Incorporating lessons learned into policy adjustments and operational enhancements can significantly improve the resilience of the agricultural sector to climate change,” he said.

The Research Expert called for collaboration between Government and NGOs through strengthening partnerships with Government bodies and non-governmental organizations to facilitate broader support mechanisms for farmers, including educational programs on risk management and climate-smart agriculture practices.

“As CEJ, we urge insurance companies to consider these recommendations seriously and act promptly to ensure that Weather Index Insurance fulfills its potential as a pivotal climate adaptation tool for Zambia’s agricultural sector. The success of this initiative is not only crucial for the sustainability of farming communities but also for the broader economic stability and food security of the nation,” he said.