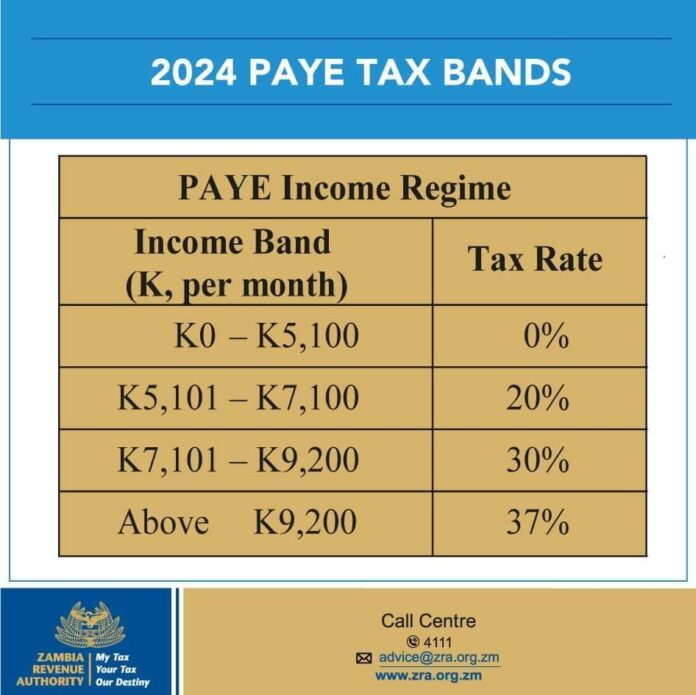

𝗨𝗻𝗱𝗲𝗿𝘀𝘁𝗮𝗻𝗱𝗶𝗻𝗴 𝘁𝗵𝗲 𝘁𝗿𝗲𝗻𝗱𝗶𝗻𝗴 𝗣𝗔𝗬𝗘 𝘁𝗮𝘅 𝗽𝗶𝗰𝘁𝘂𝗿𝗲.

I’m sure by now many of you have seen this picture trending. Unfortunately, people are misinterpreting how much tax people are paying.

This picture isn’t saying, that if you are earning K10,000 you pay 37% (K3,700) in taxes. Our tax is high but not that high 😅.

𝗟𝗲𝘁 𝗺𝗲 𝗲𝘅𝗽𝗹𝗮𝗶𝗻…

Our tax is what’s known as progressive, you don’t pay the same amount of tax on all the kwachas you earn.

Using the same example of K10,000 this is the breakdown:

● The first K5,100 for everyone is tax free. So if your gross is K5,100 zero tax is deducted.

● The next K2,000 above that K5,100 is what gets taxed at 20%. So if you earned K7,100, you only pay 20% of K2,000 in taxes. Which is K400

● The next K2,100 above the K7,100 is what is taxed at 30% =K630.

● Then, finally, only the amounts above K9,200 that are remaining get taxed at the highest threshold of 37%.

In this case if you are earning K10,000 the remaining amount to be taxed is K800. Which would give a tax burden of K296.

𝗧𝗵𝗲𝗿𝗲𝗳𝗼𝗿𝗲 𝗶𝗻 𝘁𝗼𝘁𝗮𝗹…

You were never charged 37% on the full K10,000 which would be K3,700

But “only” K400 + K630 + K296 = 𝗞𝟭,𝟯𝟮𝟲.

I hope this clears this up. 🙏🏾 Make sure to share this post so others can understand as well how paye tax is 𝒂𝒄𝒕𝒖𝒂𝒍𝒍𝒚 calculated.

NB: This is strictly calculating tax deductions and does not include NAPSA, Nhima and other deductions you may have.

Credit: Chanozya Kabaghe

GET MORE NEWS UPDATES